- 01.22.21 •

Reflecting on eClosings in 2020: A Strange Saga of Progress & Learning

2020 is a year that most of us would like to put behind us and forget, but as time passes, we may be able to reflect and see valuable lessons may have been learned during such a strange year. Nobody could have predicted a global pandemic, stay at home orders, social distancing, remote work, numerous Zoom meetings, and record levels of Netflix binging.

And while the mortgage business was already slowly progressing toward a more digital experience, the global pandemic combined with record low interest rates dramatically accelerated the adoption of digital mortgage processes beyond what anyone might have projected. Just like the great recession of 2007-2009 and the subsequent regulatory reaction swiftly and significantly changed many aspects of the business, we may look back on 2020 as an inflection point in the adoption of digital lending processes in the mortgage industry.

By all accounts the number of lenders pursuing eClosing has dramatically increased. In May of 2020 the number of companies equipped to perform eClosings had already doubled from the number of Fall 2019[1]. Companies such as First American Docutech, offering digital mortgage closing solutions have doubled or tripled the number of clients using some form of eClosings, and those that were already digitizing this process were adding volume or becoming more and more digital.

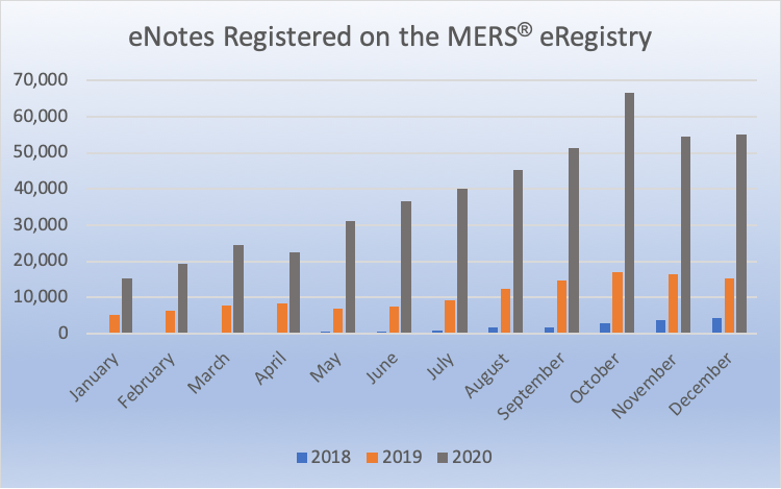

The use of eNotes has continued to increase as digital lending has accelerated. The Federal Home Loan Banks joined Fannie Mae, Freddie Mac, and Ginnie Mae as investors that will accept eNotes. The MERS eNote eRegistry is used by lenders and market participants to track the control and ownership eNotes. 2020 was a record year for eNotes, with 462,671 registered on the MERS® eRegistry, shattering the previous record set in 2019 of 127,178. The numbers reflect the sentiment that digital mortgage lending is accelerating.

In December, 55,076 eNotes were registered on the MERS® eRegistry, a 261% YOY increase.

Many lenders are reporting success in implementing digital closing strategies. Rocket Mortgage has been particularly successful in their implementation. They recently became the first lender to use eNotes to close a Ginnie Mae-backed loan as part of a pilot program. They expect to see greater success as they anticipate widespread eClosings of Ginnie Mae loans by the end of this year. Over the past year, Rocket has dramatically accelerated their digital ending program, reporting that in the first three quarters of 2020 they originated 90% of all eClosings using an eNote[2].

The strange year of 2020 continued to see the expansion of state laws allowing for the use of Remote Online Notarization (RON). In October, Pennsylvania become the 29th state to enact some form of a RON law. Many other states enacted temporary RON legislation or enacted RON by temporary executive order to help businesses cope with the effects of COVID-19 physical distancing and shut down orders. We even saw the creation of yet another eClose-related acronym Remote Ink-Signed Notarization or RIN. RIN is a temporarily approved alternative to in-person notarization where the notary observes the signature of a document through the use of audio-visual technology, the ink signed documents are then sent to the notary who signs the notarial certificates and applies the notarial seal afterward. At this time, we are unaware of any market investors who will accept loans closed using a RIN process, so it hasn’t had much of an impact, but it is another example of how legal authorities attempted to support paper-based processes during a time of national crisis and uncertainty. The fact that several jurisdictions temporarily instituted RIN as an acceptable notarization method is a testament to the strangeness this year has produced, it is terribly unlikely that RIN would have been instituted under any other circumstance.

It seems that the prevailing viewpoint in mortgage industry circles is that the unique constraints of the year 2020 accelerated the adoption of eClosing by three to five times what it would otherwise have been. That is hardly a scientific number, but it reflects the general view that the industry received a significant boost towards adopting digital processes this past year. Most agree that we will look back on 2020 and view it as a point of inflection, when the traditionally slow to adopt change mortgage industry, started to move aggressively towards digitization.

There is no turning back or slowing down at this point. Lenders are now experiencing the increased efficiency, lowered costs, and increased compliance that can be achieved by adopting eClose. More importantly, consumers expect the mortgage lending process to be as easy for them as other types of transactions that are completely digital. No consumer was ever sold on the functionality of an eNote, but they do expect the convenience of being able to sign documents electronically, including a note or security instrument. The industry needs to be able to adapt the preferences of consumers whether they want to interact with their lender in-person, by phone, text, email, or via lending portal. They want convenience and they want options and functionality that make the mortgage lending process as easy as it can be.

Considering all this change, what lesson should we take from 2020 in regard to mortgage technology? The biggest lesson is that we should be flexible and be adaptable to unforeseen business conditions. One specific way that we can do this is by aggressively adopting new technology that makes sense from a business and consumer perspective as quickly as possible. Those lenders that had already begun digitizing their lending processes were significantly better equipped to deal with the unique challenges posed by 2020. At First American Docutech, we often say that our customers should strive to be as ‘e’ as they can be. While implementing an eNote and adopting RON can be a very complex and daunting task, taking steps to digitize your disclosure process and adopting some form of hybrid eClose is not as difficult as one might think. We often are stagnated by trying to implement big changes all at once without taking advantage of easy wins. We should be strategic in the way we take these steps, but if 2020 has taught us anything, we should not delay improvement until it is too late.

At First American Docutech, we’re here to help you get started with eClosing. See how much you can save by running our eClosing ROI calculator.

Request a demo to learn how our Solex eClosing platform can help you close more loans faster.

[1]https://www.ginniemae.gov/newsroom/Pages/PressReleaseDispPage.aspx?ParamID=203